Benefits And Schemes

The pregnancy was just the beginning. The first few years of your child’s life is where it starts getting serious. As a single mother, you will probably face challenges such as having to raise a child on a single income or explaining to your child why he/she is the only one who doesn’t need to write a card for his/her daddy on Father’s Day. Take a deep breath and keep going.

There are a few schemes which only married mothers are entitled to. However, help is still available to single and pregnant mothers through many other schemes and subsidies.

A Helping Hand: Christabel

Her daughter’s medical condition was an area of great concern for Christabel. She knew she wouldn’t be able to pay for her daughter’s prosthetic hand on her income. Fortunately, with help from her social worker and subsequently SGEnable, which funded almost 70 – 80% of the total cost of the prosthetic, she was able to offer her daughter a normal life.

It may seem as if unmarried mothers are highly disadvantaged in Singapore. Regardless, make the best of what you have and tap into the benefits that are available to you. Find out what these benefits are.

Every mother and child deserves the best support they can get to succeed in life regardless of her marital status.

Employment Leave Schemes

Maternity Leave

As a working mother (regardless of the marital status effective from 1 January 2017), you will be entitled to either 16 weeks of Government-Paid Maternity Leave, or 12 weeks of maternity leave (i.e. Government-Paid Maternity Benefit), depending on whether your child is a Singapore citizen and other criteria.

1. Government-Paid Maternity Leave (GPML)

Eligibility for 16 weeks if you meet the following requirements:

- Your child is a Singapore citizen.

- You are lawfully married to your child’s father; or you are a single unmarried mother whose citizen child is born or with estimated delivery date (EDD) on or after 1 January 2017.

- For employees: you have served your employer for a continuous period of at least 3 months immediately before the birth of your child.

- For self-employed: you have been engaged in your work for at least 3 continuous months and have lost income during the maternity leave period.

- You have given your employer at least one week notice before going on maternity leave, and informed them as soon as possible of your delivery. Otherwise, you are only entitled to half the payment during maternity leave, unless you have a good enough reason for not giving the notice.

Read more on how to plan your leave.

To find out your maternity leave eligibility and entitlement, take the eligibility test here.

2. Government-Paid Maternity Benefit (GPMB)

The GPMB scheme supports working mothers (including self-employed) who do not qualify for the Government-Paid Maternity Leave scheme, typically those under short-term employment periods, or whose child is not a Singapore citizen.

Paternity Leave (for information)

From 1 January 2017, as a working father (who is or had been lawfully married to the child’s mother between conception and birth), you are entitled to 2 weeks of paid paternity leave funded by the Government.

Eligibility for 2 weeks if you meet the following requirements:

- Your child is a Singapore citizen.

- You are or had been lawfully married to the child’s mother between conception and birth. (Not applicable for adoptive fathers whose formal intent to adopt is on or after 1 January 2017.)

- For employees: you have served your employer for a continuous period of at least 3 months before the birth of your child.

- For self-employed: you have been engaged in your work for a continuous period of at least 3 months before the birth of your child, and have lost income during the paternity leave period.

Read more on how to plan your leave.

Unpaid Infant Care Leave (child below age of 2)

As a working parent you are entitled to 6 days of unpaid infant care leave a year, regardless of the number of children.

Eligibility:

- Your child is below 2 years of age.

- Your child is a Singapore Citizen.

- You have served your employer for a continuous period of at least 3 months.

In addition to 6 days of unpaid infant care leave a year, you are also entitled to 6 days of paid childcare leave if your child is a Singapore Citizen and below the age of 7 (see below).

Paid Child Care Leave (child below age of 7)

As a working parent, you are entitled to 6 days of paid child care leave a year, regardless of the number of children. Your youngest child must be a Singapore Citizen and below the age of 7.

Eligibility:

- Your youngest child is below 7 years old.

- Your child is a Singapore Citizen.

- For employees: You must have served your current employer for a continuous period of at least 3 months.

- For self-employed: You must be engaged in your business, trade or profession for a continuous period of at least 3 months.

Extended Child Care Leave (child age between 7 and 12)

As a working parent, you are entitled to 2 days of paid extended child care leave a year, regardless of the number of children. Your youngest child must be a Singapore Citizen and between 7 and 12 years old.

Eligibility:

- Your youngest child is between 7 and 12 years old, both inclusive.

- Your child is a Singapore Citizen.

- For employees: You must have served your current employer for a continuous period of at least 3 months.

- For self-employed: You must be engaged in your business, trade or profession for a continuous period of at least 3 months.

What if I am not eligible?

If you are an employee covered under the Employment Act, you are entitled to 2 days of paid child care leave a year as long as your child is below 7 years old. More information can be found at Ministry of Manpower’s (MOM) website.

Find out more information:

Ministry of Manpower (MOM)

Website: http://www.mom.gov.sg

Tel: 6438 5122 (Mondays to Fridays: 8.30am to 5.30pm; Saturdays: 8.30am to 1pm)

Address: MOM Services Centre, 1500 Bendemeer Road, Singapore 339946

Education And Care Schemes

Baby Bonus Scheme

What is it:

You would most likely have heard of the Baby Bonus Scheme, which gives out bountiful cash grants to married couples. Although children of unmarried parents are not eligible for cash grants, nonetheless starting from 1 September 2016, they will be included in the Child Development Account (CDA) scheme which has two components, the First Step Grant, and Government co-matching of parents’ savings. Click here for more information.

You can use the savings in the CDA to pay for educational and healthcare expenses of all your children at the following Baby Bonus Approved Institutions:

- Child Care Centre licensed by Early Childhood Development Agency (EDCA)

- Kindergarten registered with ECDA or the Council for Private Education (CPE) and special education school registered with the Ministry of Education (MOE) respectively

- Hospitals, clinics and other healthcare institutions licensed by the Ministry of Health (MOH)

- Pharmacies registered with the Health Sciences Authority (HSA)

- Early intervention programmes registered with MSF

- Optical shops registered with the Accounting and Corporate Regulatory Authority (ACRA)

- Assistive technology device providers registered either with NCSS, MOH or ACRA

To be eligible:

You child is a Singapore Citizen born or has an estimated date of delivery on or after 1 September 2016.

How to join:

To join the baby bonus scheme, click on this link. Enter your SingPass details and fill up the online form.

Find out more information:

Ministry of Social and Family Development (MSF)

Baby Bonus and Leave Branch

Address: Family@Enabling Village, 20 Lengkok Bahru, #04-02, Singapore 159053

Office Hours: 8.30am to 5.30pm, Mondays to Thursdays; 8.30am to 5.00pm, Fridays

Infant Care / Child Care

What is it:

The Early Childhood Development Agency (ECDA) provides 2 types of subsidies to help parents lessen the cost of infant care (for children aged 2 to 18 months) and child care (for children aged above 18 months to below 7 years old) services.

The 2 subsidies are Basic Subsidy and Additional Subsidy. Click here for more information.

For more information (e.g. amount of subsidies, eligibility, determination of household income, application procedure, etc.), refer to this link and also FAQ for Centre-based Infant and Child Care Subsidies.

To search preschools , click here (Preschool search portal).

Find out how much subsidy you’re eligible for here.

Early Childhood Development Agency (ECDA)

Website: https://www.ecda.gov.sg

Address: 51 Cuppage Road, #08-01, Singapore (229469)

Tel: 6735 9213

ComCare Child Care Subsidies

What is it:

ComCare Child Care Subsidy is a further child care financial assistance given to low income families with extenuating circumstances.

Applications can be made through the child care centre if the families are unable to afford childcare fees even after the Basic and Additional Subsidies. They can also apply for a one-time grant to cover the initial start-up costs of enrolling a child in the centre.

For more information, please approach the child care centre your child is enrolled in.

Kindergarten Financial Assistance Scheme (KiFAS)

Given Basic and Additional Subsidies are only applicable for children enrolled in ECDA-licensed child care centres, you may be wondering if there are any equivalent subsidy enhancements for kindergartens.

What is it:

The Kindergarten Fee Assistance Scheme (KiFAS) helps parents defray their children’s kindergarten fees and is administered by the Early Childhood Development Agency (ECDA). From January 2020, KiFAS will be extended to families with Singapore citizen children attending kindergarten programmes run by Anchor Operators or the Ministry of Education, if their gross monthly household income is $12,000 and below. Eligible low-income families may also apply for a yearly grant to cover the start-up costs of enrolling their children in the kindergarten.

More information can be found on the Early Childhood Development Agency (ECDA)’s website.

Eligible families may apply for KiFAS through the kindergarten.

Start Up Grant (SUG)

What is it:

For additional financial assistance, parents whose Singapore Citizen child is enrolled in an AOP or MOE kindergarten may apply for Start Up Grant (SUG) which can be used to pay for items such as the deposit, registration fee, uniforms and insurance fee.

Application should be made through your child’s kindergarten.

ComCare Student Care Financial Assistance (SCFA)

What is it:

The ComCare Student Care Financial Assistance (SCFA) provides subsidies for parents with children enrolled in student care services. As with most subsidies, families from lower income tiers will receive higher subsidy amounts.

Find out how much subsidy you’re eligible for here.

If you need more subsidy, request for the student care operator to make an appeal to a social worker from any Family Service to obtain a Letter of Recommendation.

ComCare and Social Support Division (MSF)

Website: www.msf.gov.sg/ComCare

Tel: 1800 222 0000 (Mondays to Sundays, 7am – 12 midnight)

Address: 512 Thomson Road, #15-00 MSF Building, Singapore 298136

Financial assistance for education

Singapore Citizens in financial need can get assistance on school fees and other expenses. This applies to government, government-aided, specialised and some independent schools.

MOE Financial Assistance Scheme (MOE FAS)

Awards and scholarships

Click here to learn about the different merit-based awards and scholarships available.

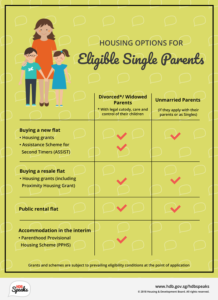

Supporting Housing Needs of Unmarried Parents

Unmarried parents who require housing assistance can approach HDB, and HDB will assess each request holistically, based on their individual circumstances. Our key consideration is to ensure that their children have a stable home to grow up in and a good start in life.

HDB will exercise flexibility in allowing unmarried parents aged 21 and above to buy up to a 3-room flat in a non-mature estate from HDB, or a resale flat. Those who cannot afford to buy a flat may be considered for public rental flats.

Beyond providing housing options, HDB also works with social service agencies to help unmarried parents who require further assistance such as employment support, financial assistance, and counselling.

Other Types Of Support

Here are other grants and subsidies that are automatically given without the need for application:

Medisave Maternity Package

The Medisave withdrawal limit for pre-delivery expenses is $900 (doubled from $450 previously) for mothers who delivere on or after 24 March 2016.

Pre-delivery expenses generally refer to pre-natal consultations, ultrasound scans, tests and medications, on top of the Medisave Withdrawal Limits for delivery expenses, incurred at both public and private healthcare institutions.

To claim for pre-delivery charges from Medisave, you need to present the bills incurred for pre-delivery medical care to the hospital where your baby is delivered. The hospital will help you submit these bills, together with the delivery expenses, for Medisave claims under the Medisave Maternity Package.

Q: What is the average amount that Singaporeans spend on pre-delivery expenses? On average, how much would a Singaporean couple see their out of pocket (OOP) costs reduced, by the policy change?

A: The amount of pre-delivery expenses can vary significantly, depending on the type of care that the couple chooses and whether it is subsidised or not. Basic subsidised pre-delivery care in KKH, including consultations, investigations and scans, costs about $900. This can be fully covered by the enhanced Medisave Maternity Package.

For more information on the Medisave Maternity Package, please visit MOH’s website.

MediSave Grant for Newborns

Eligibility

The MediSave grant for newborn is a $4,000 grant given to all Singapore Citizen newborns born on or after 1 January 2015, or have an estimated date of delivery (EDD) on or after 1 January 2015. These include children who are adopted as well as children who are born to divorced or unwed mothers. Simply put, eligibility for the grant is not affected by the marital status of the parents.

Children who are born overseas can qualify for the grant upon registering their birth with the Immigration and Checkpoints Authority (ICA) directly, or through the Singapore Mission Overseas. Newborns who are Permanent Residents (PRs) or foreigners are not eligible.

A CPF MediSave account will be opened for each newborn and the grant will be credited automatically.

Uses

The Medisave Grant for Newborns can be used in the same way as the rest of Medisave.

The Medisave Grant can be used for the MediShield Life* premiums for the child. MediShield Life is a basic health insurance scheme that will cover all Singaporeans, for life.

Medisave can also be used to pay for medical expenses incurred from hospitalisations, approved day surgeries and approved outpatient treatments, including recommended vaccinations on the National Childhood Immunisation Programme.

* MediShield Life is a mandatory basic health insurance that helps to pay for large hospital bills and selected costly outpatient treatments. All Singapore Citizen babies are automatically covered by MediShield Life from birth, including those with congenital and neonatal conditions, for life. The MediSave grant is intended to pay for the child’s MediShield Life Premiums till he or she is 21 and also to support other healthcare expenditures such as childhood vaccinations, hospitalisation, approved outpatient treatments, etc.

For queries regarding the Medisave Grant for Newborns (e.g. check your child’s Medisave balance), you can contact the Central Provident Fund Board (CPF Board) at 1800-227-1188 or member@cpf.gov.sg to submit an enquiry.

Find out more information:

Ministry of Health (MOH)

Website: http://www.moh.gov.sg

CPF Board

Tel: 1800 227 1188

Email address: medgrant_newborn@cpf.gov.sg

Levy concession for Foreign Domestic Worker (FDW)

If you are intending to hire a FDW to take care of your Singapore Citizen child, you will be eligible for a concession of $205 off the monthly foreign domestic worker levy fee of $265. This means that under the Young Child Scheme, you are automatically eligible for a reduced levy rate of $60 per month.

Find out more information: (link to “Where to get help database”)

Ministry of Manpower (MOM)

Website: http://www.mom.gov.sg

Tel: 6438 5122 (Mondays to Fridays: 8.30am to 5.30pm; Saturdays: 8.30am to 1pm)

Address: MOM Services Centre, 1500 Bendemeer Road, Singapore 339946

Child Development Credits & Post-Secondary Education Account (PSEA)

Child Development Credits are credited time-to-time into your child’s CDA by the government. These credits can be used for your child’s education and medical expenses. Any leftover credit in the child’s CDA is transferred to his/her PSEA account, which will also similarly receive top-ups, when he or she turns 13.

Find out more information:

Ministry of Education (MOE)

Website: https://www.moe.gov.sg

Hotline: 6872 2220 (Mondays to Fridays: 8.30am to 5.30pm; Saturdays: 8.30am to 12.30pm)

Email address: contact@moe.gov.sg

Address: Customer Service Centre, Podium Block of MOE Building, 1 North Buona Vista Drive, Singapore 138675